Collateralised Borrowing

The core feature of each Red Bank is the facilitation of peer-to-peer 'overcollateralized' token borrowing/lending among users on the relevant Outpost.

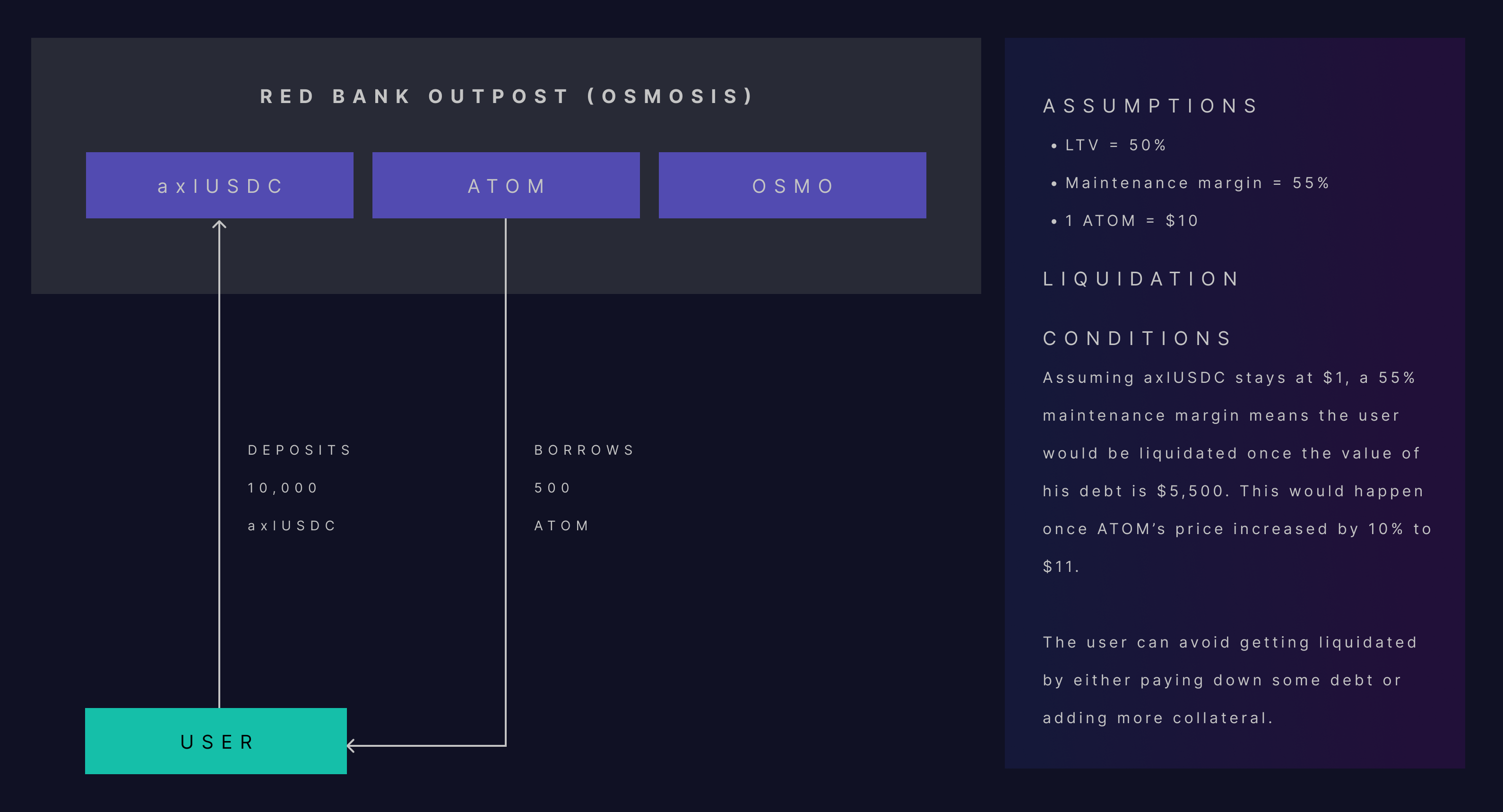

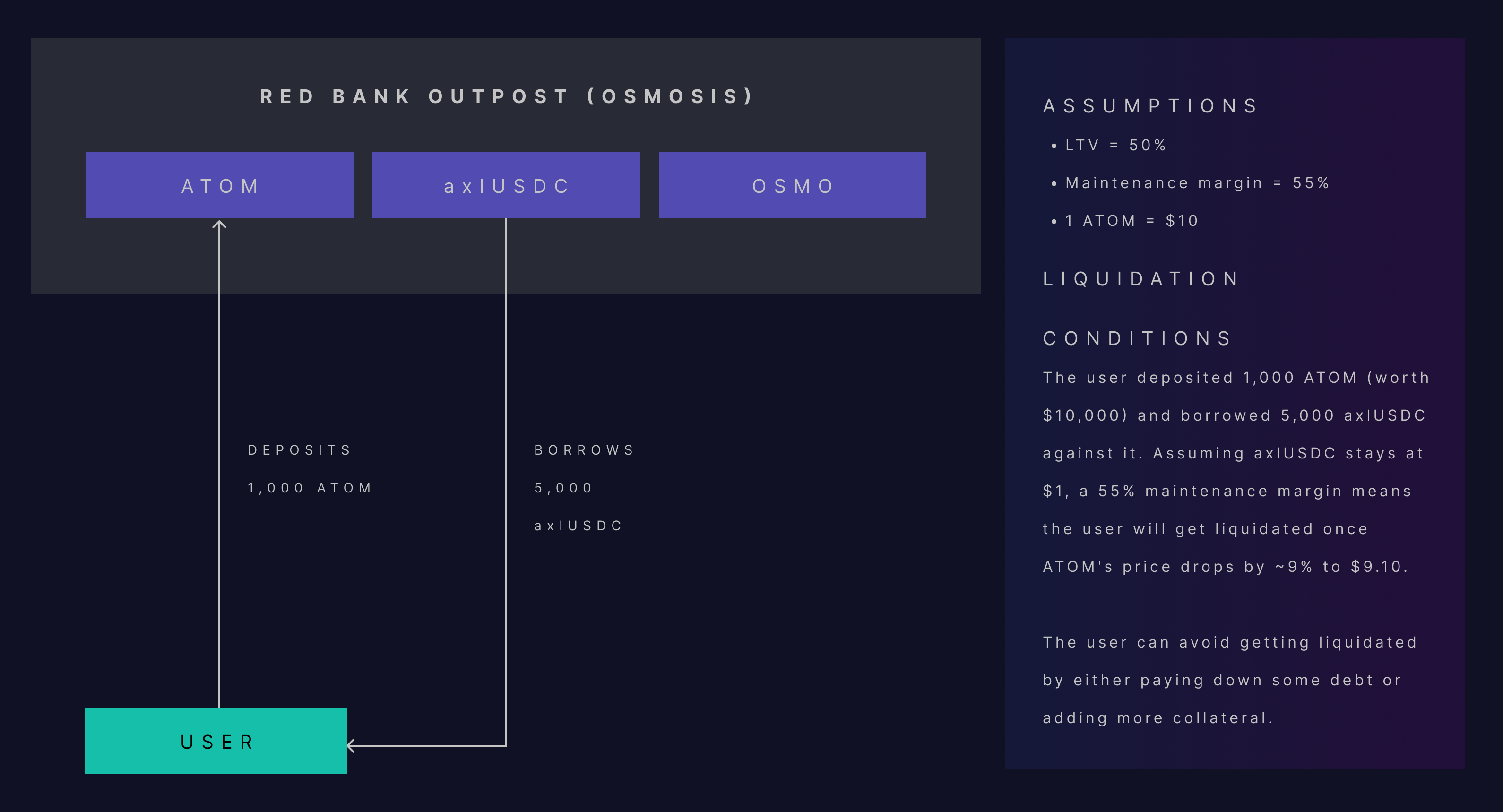

In this type of lending/borrowing, depositors may also borrow other tokens from the other depositors (through the Red Bank), but the value of the borrowers' own Red Bank token deposits must sufficiently exceed the value of the tokens they are borrowing. Each borrower's collateral within the Red Bank becomes subject to incentivized liquidation if the applicable loan-to-value (LTV) ratio falls below governance-determined safety levels.

The first Red Bank outpost is expected to launch on Osmosis with borrowing and lending support for ATOM, OSMO and axlUSDC (Axelar USDC).

Since Mars is designed to be asset-agnostic — and able to support any native Cosmos asset — the community will then be able to propose further assets to be listed. To facilitate its deliberations, the Martian Council is expected to adopt an open-source framework for setting risk parameters and assessing the riskiness of specific assets.

The following figures illustrate collateralised borrowing and how loan-to-value and margin maintenance work with volatile assets.

Borrowing volatile assets with stablecoin collateral

Borrowing stablecoin assets with volatile collateral